What properties do transactions have?

Transactions in banking accounts have the following properties that can be edited using the transaction editor. For a list of transaction properties pertaining to investment accounts, see the section about properties in Investment Transactions.

Type

This describes the activity associated with the transaction, typically some variation of withdrawal (debit) or deposit (credit). Some transaction types have values (positive or negative) assigned to them and will hide or show the "Expense" and "Income" fields in the transaction editor accordingly. For detailed descriptions of the various types, see Transaction Types.

# (Transaction Number)

A unique transaction number is shown here, most commonly used for checks but also available for other transaction types. When the "Check" type is assigned to a new transaction, the # field will automatically be assigned the number that follows the last check number recorded in the account. You can manually change this number before saving the transaction details.

Currency

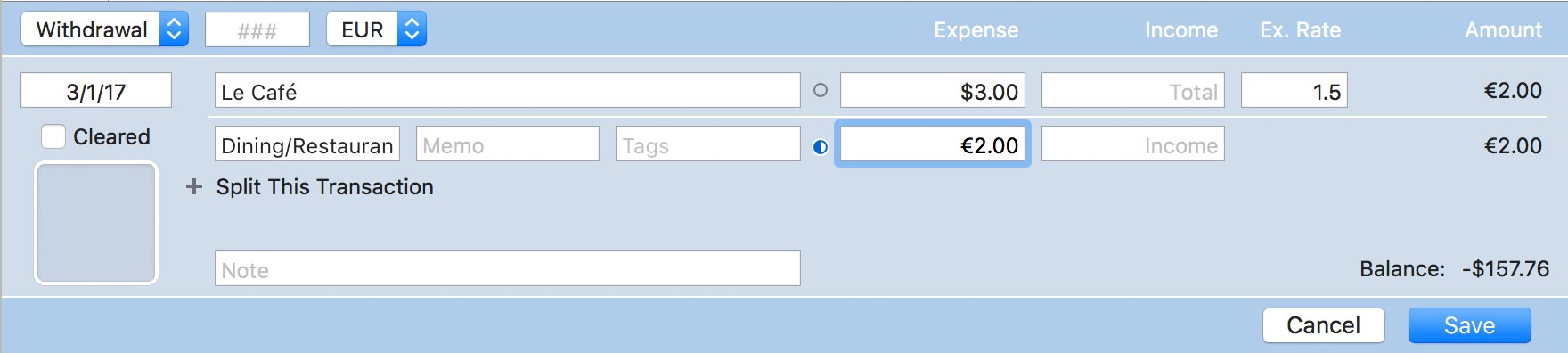

This shows the currency in which the transaction was conducted (only visible if you are using multiple currencies). In most cases, this will match the account's default currency, but you can change it to record the transaction in a different currency. Changing the currency will enable the "Ex. Rate" field, which you can use to record the exchange rate between the transaction currency and the account currency:

In this example, a cup of coffee was purchased for 2.00 Euro through an account that uses U.S. Dollars. An exchange rate of 1.5 was applied, so the final withdrawal (in USD) was 3.00. By default, only currencies that are assigned to your accounts are shown in the currency popup menu. For more information, see Multiple Currencies.

Date

The date on which the transaction occurred is shown here, or the date on which the transaction was cleared by your bank. It is up to you which date you prefer to track - just remember to be consistent. By default, new transactions are assigned the current date.

If you type in a date, even if it does not match the format displayed, Banktivity will attempt to interpret it into the format displayed. For example, if you type "15" in the date field, Banktivity will assume you mean the 15th day of the current month and year, and enter that date. If you type "321", Banktivity will assume you mean March 21 of the current year.

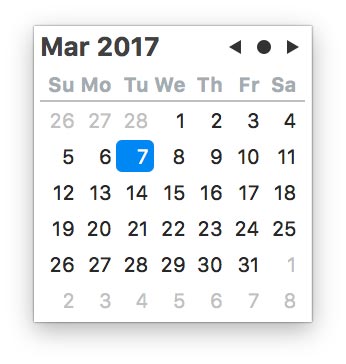

When editing dates, a small calendar appears to help you choose a date. When the calendar is visible, use the arrow keys to move the selection or click the buttons at the top right to navigate. Click the arrows to change the month displayed, or click the dot between the arrows to return to the current selection. Click a date to enter it, or press the Tab key to accept whatever date is currently selected.

Whether or not the calendar is showing, you can use the [ (left square bracket) and ] (right square bracket) keys to decrement and increment, respectively, the day.

If you record a transaction with a date in the future, a plus symbol (+) will appear next to its date in the transaction register.

Dates are displayed in the register using your system's "Short" date format. To change the system format, open System Preferences, click the "Language & Region" button, click the "Advanced" button, and click the "Dates" tab. Edit the "Short" format as desired, then close System Preferences and relaunch Banktivity to see the changes.

Status

One of three icons will appear here for each transaction:

Uncleared: This transaction was recorded manually in Banktivity (or synced from another device) and has not yet been cleared by the financial institution. Check the box in the transaction editor (or click the circle in the account register) to change the status to "cleared."

Uncleared: This transaction was recorded manually in Banktivity (or synced from another device) and has not yet been cleared by the financial institution. Check the box in the transaction editor (or click the circle in the account register) to change the status to "cleared."

The first line of each uncleared transaction in the account register is displayed in bold type. Uncleared transactions are counted as part of the account balance, but excluded from the "cleared balance" on Account Summary reports.

Cleared: This transaction has been processed successfully and recorded by your financial institution. Transactions can be checked off manually, or may be checked automatically by Banktivity for any of these reasons:

Cleared: This transaction has been processed successfully and recorded by your financial institution. Transactions can be checked off manually, or may be checked automatically by Banktivity for any of these reasons:

- They were imported into Banktivity via Direct Access, direct download, the built-in browser, or an external file. In these cases, Banktivity assumes the data was obtained from a trusted source.

- They were matched to incoming transactions during an import.

Checked transactions are counted as part of the "cleared balance" on Account Summary reports. Uncheck the box to change the transaction status to "uncleared."

Reconciled: This transaction has been recorded on a statement. When a transaction is marked "reconciled" on a statement, its checkbox is automatically replaced with a double-check icon in the account register, and its status cannot be modified. Reconciled transactions are counted as part of the "cleared balance" on Account Summary reports. In order to change the transaction status to either "cleared" or "uncleared," you must edit the transaction on the statement to which it belongs.

Reconciled: This transaction has been recorded on a statement. When a transaction is marked "reconciled" on a statement, its checkbox is automatically replaced with a double-check icon in the account register, and its status cannot be modified. Reconciled transactions are counted as part of the "cleared balance" on Account Summary reports. In order to change the transaction status to either "cleared" or "uncleared," you must edit the transaction on the statement to which it belongs.

Clear or unclear multiple transactions at once by using Command-click to select them in the account register, then choosing Transaction > Mark Cleared/Uncleared.

Image/Attachment

By default, an image is shown on the left side of the transaction that corresponds with the category assigned to it. For information about changing category images, see Editing Category Properties.

You can also click this space in the editor to attach a file to the transaction: for example, you can attach a PDF receipt from an online purchase or take a picture of your latest acquisition from the Apple Store. When an attachment is present, a document icon or image preview is shown in place of the category image. For more information, see Attaching Files.

You can also click this space in the editor to attach a file to the transaction: for example, you can attach a PDF receipt from an online purchase or take a picture of your latest acquisition from the Apple Store. When an attachment is present, a document icon or image preview is shown in place of the category image. For more information, see Attaching Files.

To hide images from the transaction register, choose Banktivity > Settings and uncheck the box next to "Show images in transaction register."

Payee

This is the name of the person or institution with whom the transaction was conducted (e.g. the name of the store where you purchased your groceries). Banktivity automatically creates memorized payees based on the payees you record i the transaction editor.

Category/Transfer

The category associated with the transaction is shown here. Categories are used to track your spending on reports and budgets. To split a transaction among multiple categories, click "Split This Transaction" and enter each category with its corresponding amount. For more detailed information about how to use categories, see Using Categories.

For transfers, this field is used to specify the name of the sending or receiving account. Autofill works the same for categories as well as account names - simply begin typing the name of the category or account, then choose the correct item from the drop-down menu that appears. Banktivity will automatically put an arrow in front of an account name to indicate the direction of the transfer.

Memo

Extra details pertaining to each split item are entered here. A transaction can have several memos (one for each category) but only one note.

Tags

Any tags associated with the transaction are shown here. Tags are used to analyze your spending on reports. When splitting transactions, tags can be assigned to each split item. For more detailed information about how to use tags, see Using Tags.

Amount

The transaction amount is shown here. Expense indicates a negative value; Income indicates a positive value. Depending on the transaction type, one or both of these fields may be available for use. To show both fields regardless of the transaction type, choose Banktivity > View > Use Simplified Register, Make sure this option is disabed if you want to see both the Withdrawal and Deposit columns. These amounts are always displayed in the account's default currency, even when an exchange rate has been applied.

When splitting transactions, each line item has its own Expense or Income amount. The top line always represents the total transaction amount; the amounts below pertain to individual split items and contribute to the total. Click the circle button (the "split balancer") on any line to have Banktivity automatically adjust that line's amount when you edit the other amounts. A half-filled circle indicates which amount is currently selected for adjustment.

Basic calculations can be performed when entering amounts. For example, if you type "5+3" in the deposit field, Banktivity will automatically record a value of "8.00". Multiplication (*) and division (/) are performed before addition (+) and subtraction (-). Amounts are rounded to two decimal places. To specify the order of operations, you may group together parts of the calculation using square brackets [ ]. For example, if you enter "[1/2]*[4-3]" in the withdrawal field, Banktivity will calculate an amount of "(0.50)". Parentheses may not be used for grouping.

Ex. Rate

This shows the rate of conversion between the transaction currency and the account currency (only available when these two currencies are different). Enter a rate and press Tab on your keyboard; Banktivity will automatically divide the rate into the total transaction amount (in the account's currency) and record the result (in the transaction's currency) on the second line. If desired, you can split the amount in the transaction's currency into multiple line items and assign each one a category.

Note

Extra details pertaining to the transaction are shown here. Examples include a tracking number for the book you just ordered from Amazon.com, or a note to help you remember whose birthday card you bought at Hallmark. Each transaction may have only one note but more than one memo (one for each category).

Balance

A running total of the account's cash value is shown here to illustrate how the total is affected by each transaction. This field is automatically calculated by Banktivity and cannot be edited. For investment accounts, note that this figure represents the value of cash in the account only - the market value of shares held in the account is not included.

Entries in the balance column are always calculated in chronological order, regardless of the current sort order. If the numbers in this column don't make sense, click the "Date" column header to make sure your transactions are sorted by date.