How do I use the Loan & Debt report?

The Loan & Debt report type is used to analyze the money you owe for loans, credit cards, lines of credit, and other liabilities. Banktivity's Loan & Debt report charts your debt over time, itemizes accounts that represent money you owe, and provides tools to help you compare alternative payment schedules.

This report is used for analyzing cash liabilities only; it does not include security liabilities. To analyze your investments, use the Investment Summary report instead.

The report's type and name are shown at the top left. The date range used for the report is at the top right. Click the arrow buttons to the left or right of the date to move backward or forward in time. Comparison periods are not available for this report.

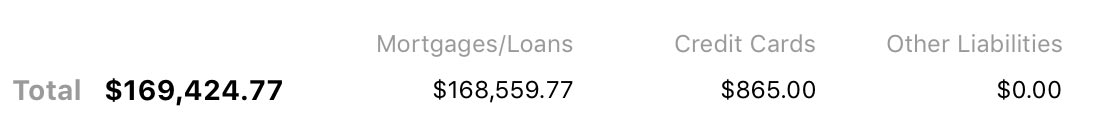

Summary table

At the top of the report are figures that summarize your debt. On the left is your total debt, which is the sum of all loan, credit card, line of credit, and liability account balances. To the right are subtotals for different account types: "Mortgages/Loans" represents your loan accounts, "Credit Cards" includes credit card and line of credit accounts, and "Other Liabilities" covers liability accounts.

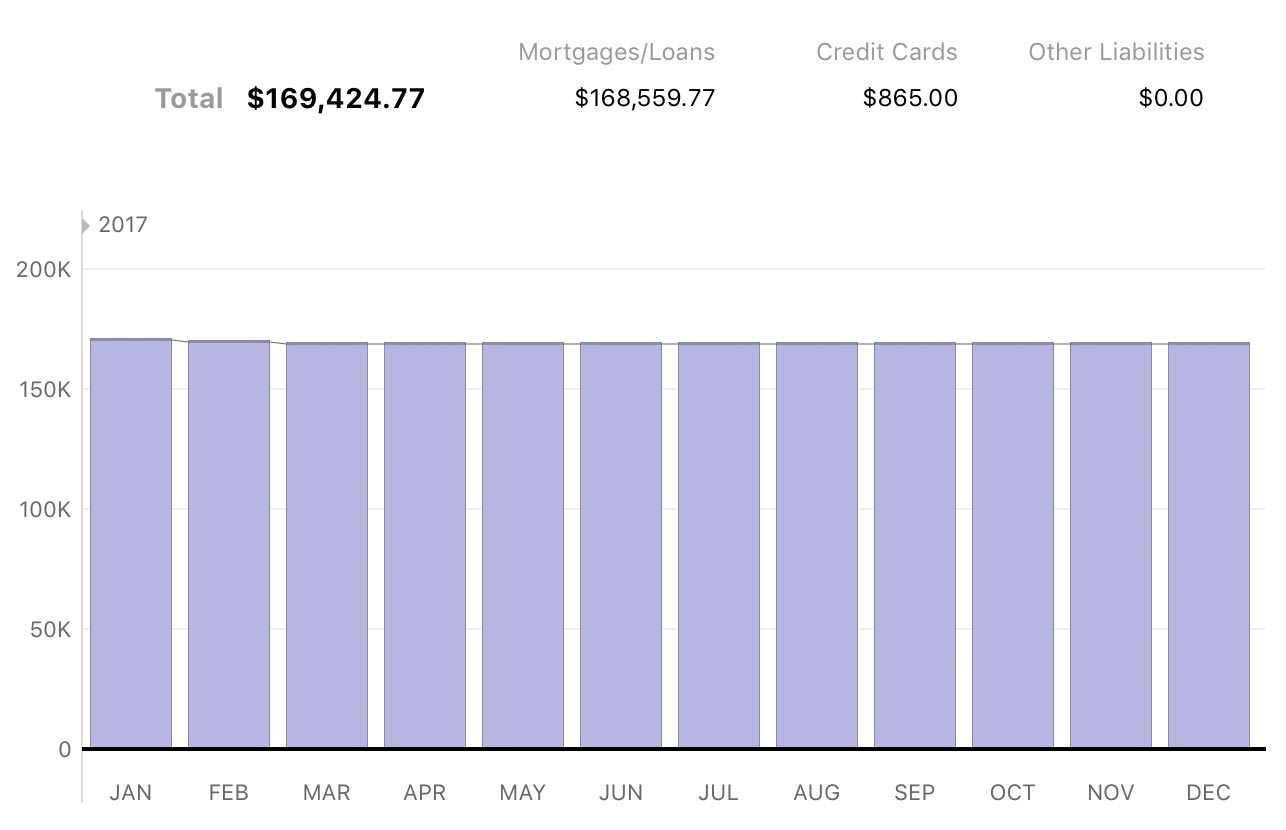

Timeline bar chart

Below the summary table is a bar chart depicting your debt over time. Each bar represents the sum of your loan, credit card, line of credit, and liability account balances at the end of a period within the report's full date range. Hover the mouse over a bar to view the time period it represents and the amount for that period. Click on a bar to view a Loan & Debt report restricted to that date range.

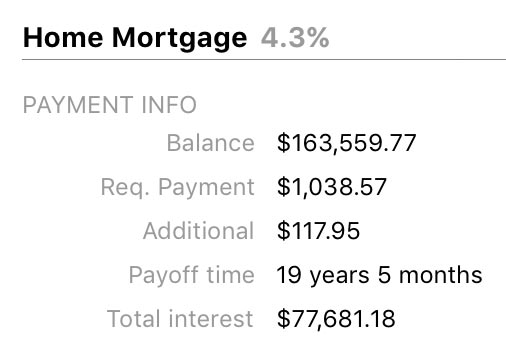

Account detail tables

Below the bar chart, debt-related accounts are listed in alphabetical order. Next to the name of each account is its interest rate. Click on an account name to drill down and view its transaction register.

To specify the interest rate for loan, select the account in the sidebar, choose Account > Edit Loan Information, and use the assistant to update the loan settings. For credit card, line of credit, and liability accounts, double-click the account in the sidebar and enter a percentage next to "Interest Rate."

Each account includes a table with details about the money you owe on the end date of the report:

- Balance: The amount you owe, equal to the current balance of the account (all account types).

- Payment: The payment amount as configured in the loan settings (loans only).

- Payoff Time: The amount of time required to pay off the loan in full, based on the current loan settings (loans only).

- Total interest: The sum of all interest payments from now until the loan is fully paid, based on the account's interest rate (loans only).

- Payment due: The due date of the next payment (credit cards and lines of credit). This information is only shown if Banktivity is able to download it using Direct Access.

- Minimum due: The payment amount required for the next payment (credit cards and lines of credit). This information is only shown if Banktivity is able to download it using Direct Access.

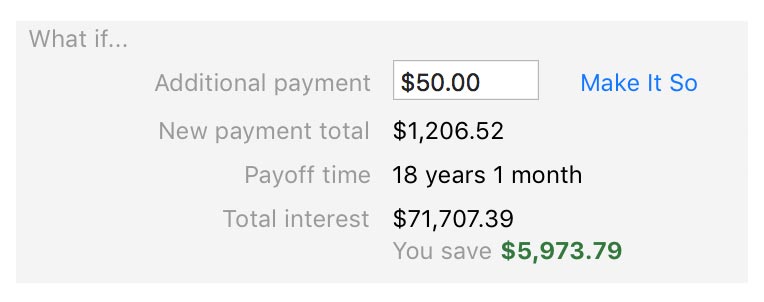

Payment calculators

To the right of each account table is a box labeled "What if...." This is a calculator which lets you estimate how changes in payment amounts would affect the time it takes to pay off the balance of that account. Type in the additional amount you would like to include with each payment (or, in the case of credit cards and lines of credit, just enter the amount you intend to pay each month), then press the Enter key. Banktivity will calculate the following figures to help you optimize your payment plan:

- New payment total: The sum of your current payment amount and the additional payment you entered in the calculator.

- Payoff time/estimated payoff: The amount of time required to pay off the loan in full, based on the current loan settings and the additional payments.

- Total/estimated interest: The sum of all interest payments from now until the loan is fully paid, based on the account's interest rate and the estimated payoff time. Banktivity also shows how much money you can expect to save on interest by increasing your payment amount.

If you find a payment plan you like, and want to adjust your loan settings to include the additional payment, simply click "Make It So." Banktivity will automatically make the necessary changes to your loan and upcoming scheduled payments.

Learn more about reports

For more information about configuring report options, see Add a Report. For more information about printing, exporting, and otherwise managing reports, see About Reports.