Yes, budgets are important – I won’t argue otherwise here. They can be crucial to getting out of debt, planning for upcoming expenses and more. But if the secret to getting your financial house in order stopped at budgets, we would be selling our customers short. In reality, really understanding your finances and getting on the path to financial freedom involves reaching beyond the big ‘B’ word. So sit back, relax and let’s explore why eventually you will need more than a budget.

I’m going to assume you’ve been sticking to a budget for at least several months. After all, this article is about why you need more than a budget. You already got the budget down, so what’s next? The rest of this article focuses on four areas of your personal finances that fall outside of budgeting. Specifically, I’m going to dive into Savings Rate, Net Worth, Taxes and Investments. I’ll cover where these metrics and features are found in Banktivity and we will discuss how to make the most of them.

Savings Rate

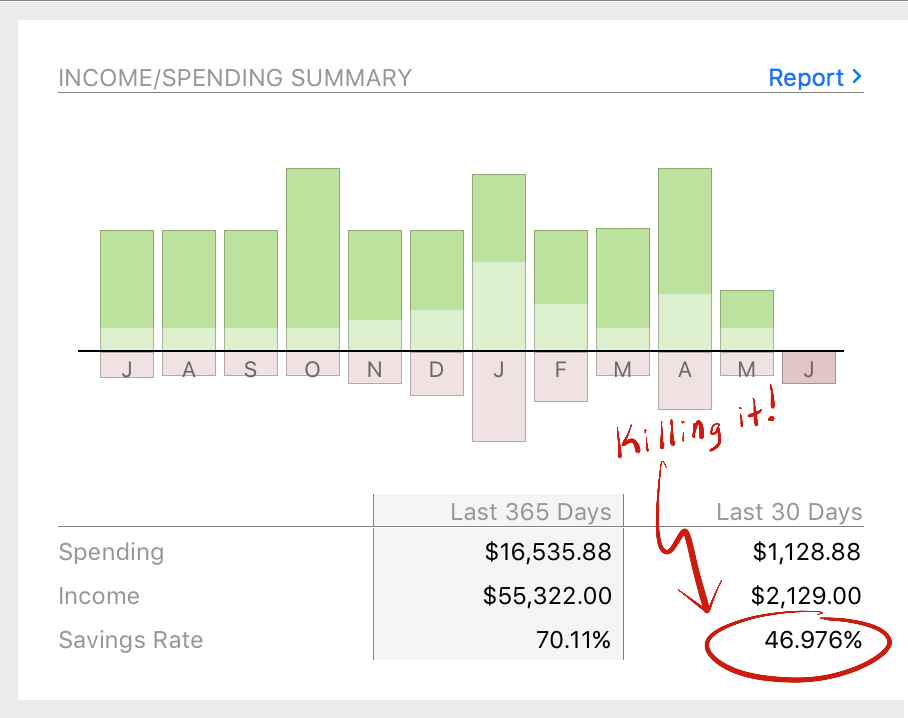

This is one of our favorite metrics because it does the best job of summarizing your immediate financial picture. Or, more specifically, it summarizes your cash flow. It lets you know if you are spending more than you earn or, in other words, living below your means. The savings rate is defined as your income – expenses / income. (I know – math, bleh!) But don’t let the formula scare you off. Here is what you need to know about savings rates: if the rate is a positive number, it means you are saving money. That is, you’re making more than you spend. If the number is negative, yep, you guessed it, you are spending more than you take in.

Here is a quick example: let’s say you get paid $2,000 each month. Your expenses come in at $1800. Great, you have saved $200 this month ($2000–$1800=$200). Your savings rate is just the amount saved compared to how much you brought in, or $200/$2000 = 10%. Now, ten percent isn’t bad, but many people that are pushing to pay off debt, build up that savings cushion or save for retirement often set their targets closer to 50%! Clearly this isn’t possible for everyone, but if you are earning a decent income and can keep your spending in check, saving 40-50% of your take home pay shouldn’t be out of the question!

In Banktivity, your savings rate is found in the summary section. We compute two numbers for you: your savings rate over the last year and your savings rate for the last 30 days. This allows you to see how you are doing in the short term and, more importantly, how you’ve been doing in the longer term. There is nothing like the honesty of seeing your savings rate over the last 365 days to see if you are taking on debt or in a position to pay down debt.

Net Worth

In many cultures, we don’t talk enough about money amongst peers and friends, but if we did, the net worth might be the number you’d share most. Your net worth is simply all of the money you have, minus all of the money you owe. Or in finance parlance, it’s:

(the fancy formula)

assets – debts = net worth

So let’s break down how you calculate your net worth. First we will start with your assets; this is the money you have.

Your assets

Your assets are everything of value. Let’s not confuse this with things you value. That dear old picture of Aunt Edna might be of value to you, but I doubt it is of much value to anyone else. For net worth calculations, we are only interested in stuff that is intrinsically valuable. The list of things of value that you own can actually be quite large, so let’s cover some of the most common assets people use to calculate their net worth. (Note, some people go crazy with this, tracking everything from furniture to appliances. While you CAN do this, I don’t recommend it – keep it simple and your future self will thank you.) First, the most obvious is cash you have in the bank. This is your checking and savings accounts. You should also include your retirement accounts in your net worth. It might not be money you have access to, but it is certainly yours.

Now let’s cover the other assets people often track for their net worth that don’t necessarily reside at a financial institution. At the top of the list, if you are a home owner, is your house. Since this is often a significant value, most people include it in their net worth. If you are a homeowner and want to include the value of your house in Banktivity, make sure you also track your home mortgage. If you don’t, you’ll just be cheating yourself because you’ll end up thinking you have a much higher net worth than you actually do. Many people also include their cars in the net worth. This a fine thing to do as long as you update the value of them frequently (they lose value quickly!) and, of course, track your car loans in Banktivity. In Banktivity, tracking these more unusual assets is easy to do by just adding “accounts” to track them.

Your debt

Now let’s move on to the money you owe: your debts and liabilities. For many people, these are credit cards and student loans. You’ll absolutely want to add these accounts in Banktivity if you want a realistic picture of your net worth. And as we noted above, you’ll certainly want to add your home mortgage and car loans if they apply to your situation. There are a few less common debts and liabilities that are worth mentioning here for the sake of completeness. If you took out a home equity line of credit on your house, you’ll want to include that. Similarly, if you borrowed money from a family member or friend, you’d better add that (we assume you’ll be paying them back!). All of these are just more “accounts” that you can easily add to Banktivity to flesh out your net worth.

In Banktivity, your net worth is found in the summary section. It’s important to point out that your net worth can be negative. In fact, for many people just graduating college with student loans, this will likely be the case. This can also happen if you own a home that significantly decreases in value, or by going on a shopping spree with your credit cards (don’t do this!).

So why do we care about net worth? This is a valid question. After all, we mentioned earlier that in many ways, it is just a bragging number. Well, as you’ve probably guessed, there is more utility to it than that. Many people use their net worth as a measuring stick of goals they are trying to achieve. For someone just graduating college, their net worth goal might just be getting to zero, that is, getting out of the negative territory. After that, it might be getting to $10,000, or $50,000 and so on.

Net worth is your one-number snapshot of your finances. If you’ve been in the work force for a while and you have a low net worth, or negative (cringe!), this can be a red flag that you are over leveraged. Net worth is also useful for gross retirement planning. Using the number for retirement planning goes like this:

How much do you want spend annually in retirement? Let’s say $60,000. Then many people would say you need your net worth to be roughly 20 times that number, or $1,200,000. Now, this is super rough, back of the envelope stuff. The point isn’t to tell you to use this formula to plan your retirement. The point is to illustrate how people use the net worth figure.

It is also very valuable to see how your net worth changes over time. It’s actually possible to be spending more than you make (negative savings rate), but have your net worth increasing through time. How can this be, you might ask? Investments. If the value of your investments (or home value) is rising fast enough, this situation is fairly easy to encounter. So in summary, it is important to look at not just your net worth, but also your net worth in the context of your savings rate, depending on your financial goals.

Taxes

The first two metrics we covered were exactly that, metrics. But now I’m going to talk about the second power of the universe, that’s right, taxes. You know, how Benjamin Franklin put it so eloquently, “…in this world, nothing is certain except death and taxes.” Yeah, those taxes. Everyone ends up paying them at some point (OK, maybe not everyone, but if you make enough money, you’ll pay them.) Anyway, where were we…yes, taxes. You need more than a budget to pay taxes. Are you claiming the child care tax credit? Better know exactly you whom paid and when. Banktivity makes getting at this info easy with quick reports!

Or how about this example: you realize you will be getting a decent tax refund, so you decide to make an (additional) tax-deductible donation to your favorite organization. But maybe you are wondering how much you gave them last year? A quick report in Banktivity will show you this. Or maybe you want to know how much you paid to all tax-deductible organizations over the course of the year – yep, reports to the rescue again. So you see, when it comes to doing your taxes, you do need more than a budget!

Investments

For many people investments, fall outside of the realm of budgets. Unless you are retired, you probably won’t be drawing down an investment account to cover your monthly spending. But this doesn’t mean you shouldn’t care about investments if you are not retired. In fact, investments are one of the most overlooked financial instruments to help build wealth.

Remember, we are assuming you’ve been sticking to your budget for several months, and let’s say you manage to save a little money every month. What should you do with this money? Your budget won’t tell you. Sure, you can put it towards something like an emergency fund, car fund, etc. But what about after that; what should you do with that money? If you want that money to work for you, investing it is one of your best options. Naturally, once you have that money invested, you’ll want to know how your investments are performing. A budget will never tell you this, but through Banktivity you can easily see how your investments are performing.

The portfolio view in Banktivity is the one-stop place to get an overview of your investments. If you need additional information, just click on a security (fancy name for a single investment) and you’ll get all sorts of metrics to geek out on.

Budgets are an outstanding tool for when you are first getting your financial house in order. They help you make sure you are spending money on the right things. They help you cut out the waste and save real dollars. Inevitably, though, a time comes when the budget doesn’t have the answers you are looking for – but don’t worry, because Banktivity does.

Whether you are just starting on your financial journey or you are a seasoned financial veteran, Banktivity is here for you. It’s time to get your financial house in order.

The investment options are too many for me. Now my investments show as an expense, and dividends as income. I cannot figure out a simple way to re-allocate the “expense” in an investment category and place the corresponding dividend income in the same category. this goes back several years, so how do I go about correcting that? I don’t need all those on-line accounts I am being directed to. Beyond that I really like Banktivity 🙂

Banktivity is the greatest thing since slice bread and canned bear! I have used many different personal accounting/financial software packages but this one is simply OUTSTANDING! I am now 8 or 9 months into using it and it is simply wonderful. I look forward to 2018 to fully utilize the program. If nothing else, it has liberated me from entering by hand 95 to 99 per cent of my MANY transactions. I would love to see a report generator that I could use although many of my report needs have already been addressed. Good Job, Bantivity!

I love Banktivity!!

Made my banking simple.

a few things a would love to add to the system includes:

1. the ability to switch of features. ie. payments, portfolios,

2. Ability to move the summary modules around to how you would like to see them.

Too many things i love about banktivity , naming a few … budget, envelope budgeting, bank integration and sync features between my Apple devices, search/find feature, changeable reports, etc etc.. 🙂