Most people find the concept of envelope budgeting fairly intuitive. You put your money into various envelopes designated for various spending categories, like Rent, Groceries, Cell Phone, etc. When you spend from one of those categories, you take the money out of the appropriate envelope to cover the expense. This works if you have physical envelopes stuffed with cash, or if you a use a personal finance software like Banktivity to manage “virtual envelopes” for you. That’s a super quick refresher on the basics of envelope budgeting. If you are new to envelope budgeting, take out a look at this great resource we’ve put together that covers the concepts with some additional detail.

So like I said, envelope budgeting is fairly intuitive, but when you apply it to some real world financial situations it’s pretty common for some questions to come up. For example, what if you have loans with interest, how do you set up envelopes for that. Or, what if your paycheck has automatic deductions to savings or retirement accounts? Or what if you don’t get a regular paycheck, but instead get paid larger amounts at erratic intervals (I’m looking at you freelancers and small business owners!)

In today’s post we are going to cover some of these more complex and also pretty common situations when envelope budgeting.

Handling Splits In Your Paycheck

Since envelope budgeting is about the money you have right now and deciding what to do with the money you are paid, let’s start with a paycheck. Many people think of their paycheck as one number – the amount that shows up (usually via direct deposit) in their checking or savings account. But for most jobs, at least if you have a have a job where you get a W2, there are other important numbers in your paycheck, like federal withholding, social security and medical deductions and sometimes, automatic transfers to some of your other accounts, like a 401k or savings account.

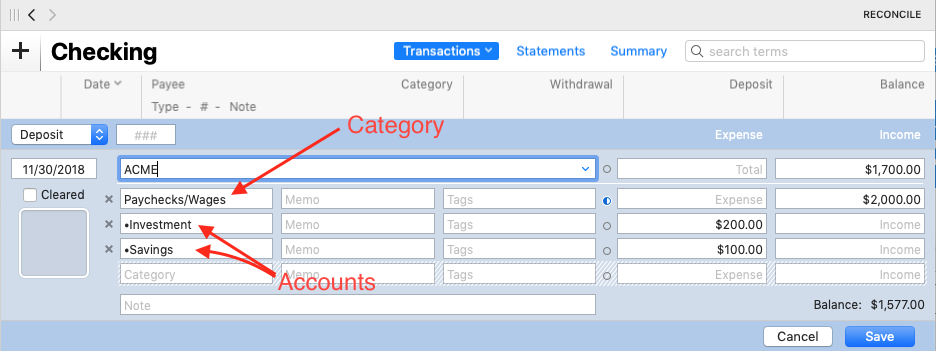

To track all of the components in a paycheck you need to “split” the transaction in Banktivity. Since we don’t readily have access to the federal withholdings, social security and medical deductions in an envelope budget, I’m going to run through an example of how to track money you have automatically transferred to a savings or retirement account.

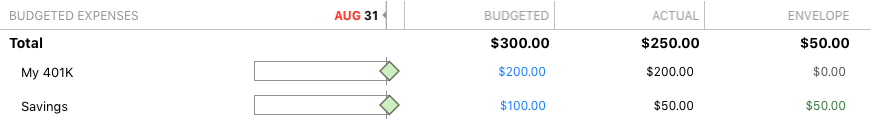

Let’s say you have automatic transfers from your paycheck to a savings account for $100 and retirement account for $200. You would record a transaction like this in Banktivity:

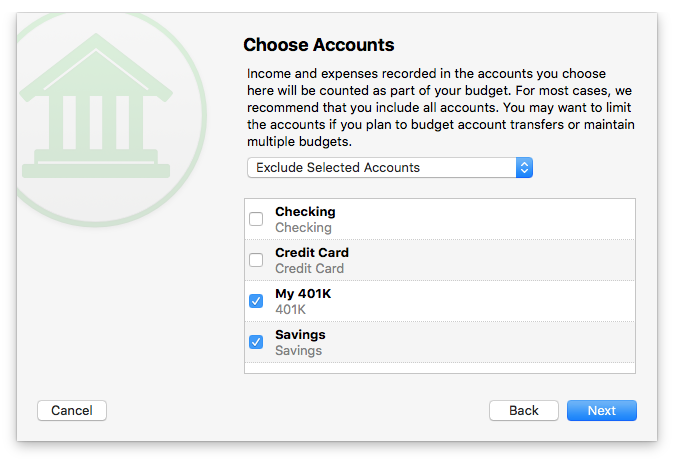

Since the $100 and $200 are part of your budget, they represent a saving priority. So let’s discuss the proper way to handle this in an envelope budget. First, since you plan on moving money *to* these accounts, we will want to exclude them from the budget. This tells the app that when I move money to these accounts I want to think of it as an expense, in that it will decrease the amount of money I have for other things.

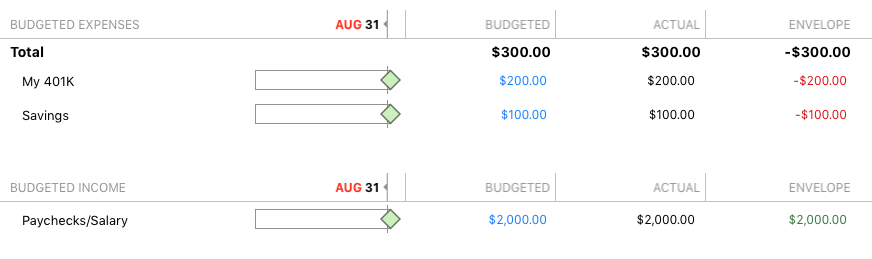

Now when you get paid and you record the split transaction either manually (or you could post it via a scheduled transaction) your envelope budget will show -100 in your Savings Account envelope and -200 in your 401k envelope. As expected, your Salary envelope will show $2,000. You’ll want transfer $100 and $200 to your Savings and 401k envelopes, respectively. Now you have funded your Savings and 401k and you’re left with a net amount of $1,700. Perfect!

Envelope budget showing you need to move some cash from your paycheck envelope to your Savings and 401k envelopes. Just click the red numbers to bring up a popover widget where you can move money to the envelope.

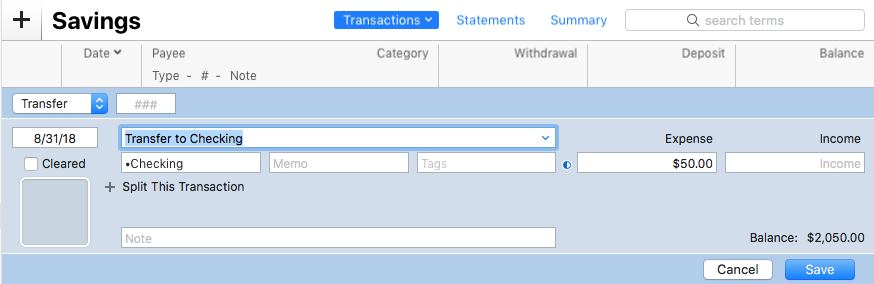

So this is all great and works as expected, but what happens when some spending activity results in us needing some of that $100 we put in to Savings. Yes, it was planned for long term savings, but things happen, emergencies happen, sh!t happens. Whatever the reason, you need that money. So you log in to your Savings account and do a transfer to your Checking account. Since you are a dedicated Banktivity user you enter a transaction like this that represents the transfer:

Transaction showing a $50 transfer from Savings to Checking

Now, when you go to your budget, you’ll see $50 available in your Savings envelope. You can then transfer this to whatever envelope is appropriate.

After you transfer $50 from Savings to Checking, you free up $50 that was in your Savings to distribute to other categories.

Envelope Budgeting With Loans

Loans and other debt instruments, for better or for worse, are a part of life for almost all adult Americans. There are school and car loans, mortgages and home equity line of credits, just to name a few. (I’m not even going to cover revolving credit area like credit cards as they are another beast in and of themselves.) For budgeting we think of the loan as having some minimum monthly payment. For example, you might have a mortgage that has $1200 minimum monthly payment.

From a budgeting perspective it is very simple, you need to make sure you have $1200 each month to pay the mortgage. But many of you probably know that when you make that mortgage payment only part of it goes to the principal amount of the loan and the rest goes to the interest and any other payments like PMI, insurance or property taxes. For the example we are going to work through let’s assume your loan can be broken into two parts, principal and interest. On a month to month basis I don’t really care how much goes to each part (it is a 30 year mortgage after all!) I just need to come up with the $1200. However, at a larger time scale I would like to know how much principal is remaining on my loan and for tax time, I’d like to know how much I’ve paid in interest. In Banktivity, it is possible to have the best of both worlds: for budgeting you only have to worry about $1200, but you can also track principal and interest separately. Here is how to do it:

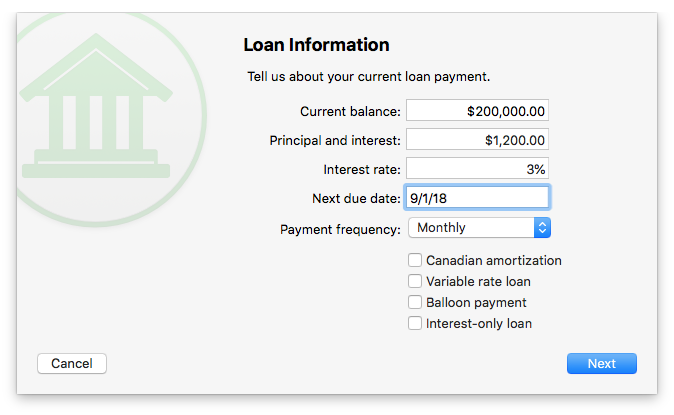

First get your loan set up in Banktivity. Here is an example of a simple mortgage:

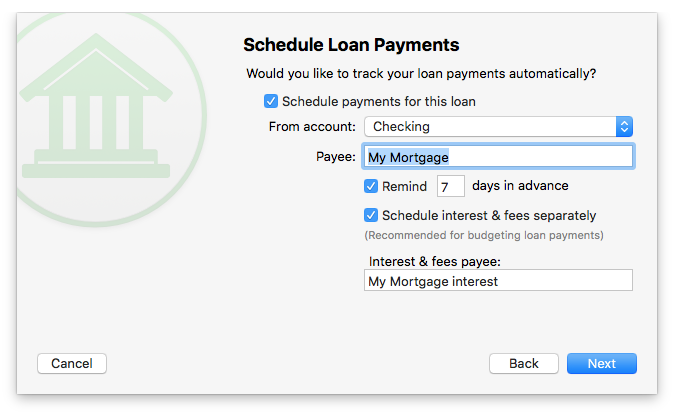

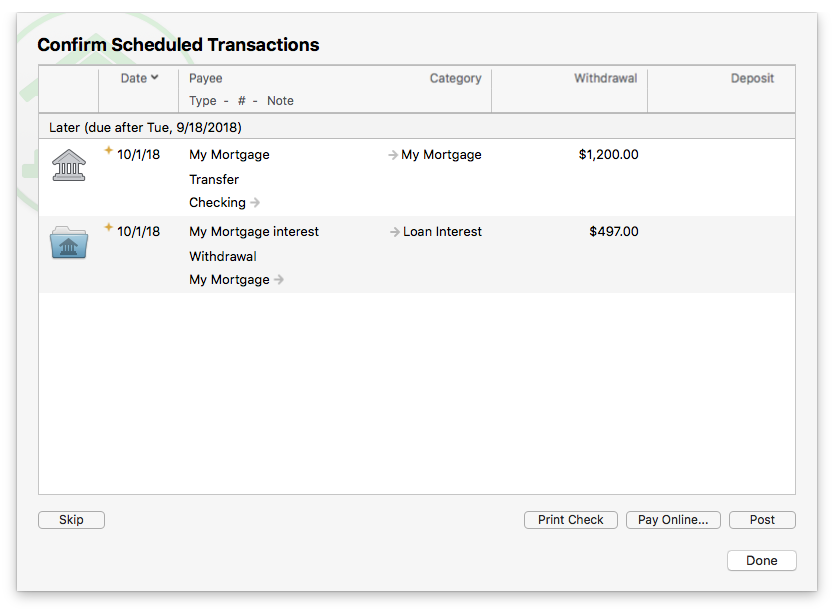

You tell Banktivity about the remaining principal, interest rate and your total monthly payment; the app will calculate the interest and principal automatically for you. On the last screen of the budget setup assistant it, Banktivity gives you the option to schedule interest and fees separately. You definitely want to check this box if you want to budget for this loan as one lump sum. When you check this box, Banktivity will actually make two scheduled transactions behind the scenes for you, one for the total amount of the monthly payment. This scheduled transaction is setup as a simple transfer from the account you plan to pay from to the loan account. Then, there is another scheduled transaction setup that posts to the loan account that is for your interest, PMI, insurance, etc. When you post the first scheduled transaction all of the amount is applied to the principal of the loan (you might be thinking this is incorrect, but don’t worry, the next transaction brings everything back into balance). Then when you post the second transaction it will correctly adjust the principal balance of the loan and track interest and any other splits.

Every month when you make your mortgage payment you’ll post both of these transactions from the Confirm Scheduled Transactions sheet. When you look at your budget, you’ll see one transaction for the total amount – this is the amount you’ll want to transfer your envelope dollars into each month.

Final screen of the loan setup assistant where you get to tell Banktivity to “Schedule interest & fees separately”

Two scheduled transactions are created so that you can budget for what makes sense on a monthly basis while also accurately tracking your loan principal and interest.

As many of you know, I’m a big proponent of envelope budgeting, but I also like to keep fairly meticulous financial records. With Banktivity you can have the best of both worlds: a real-world zero-based envelope budget and records that accurately track interest and transfers directly from paychecks.

Do you like envelope budgeting with Banktivity? Do you have any questions about best practices? If so, let us know in the comments.

This post is brilliant. I have been trying to work this out for months. I can’t check it worked for me until I next get paid, but it sounds like it is just what I was looking for.

One question I have is, in my salary split where I have addd the savings expenses, in your example $100 and $200 my split and the dot in front of it, yours does not. I know the dot means another account, not a category. Is this correct? I also have fixed at the end of each row. What is that for?

I have made a scheduled transaction for the day after pay day to transfer the $100 and $200 is that correct?

I under pay myself each month as I also get a bonus. I was wondering if I should add a bonus category to the split and add my bonus there. At present I just change the salary amount when I reconcile my accounts.

Thanks once again for a great post

This did not help. Clearly, I am too stupid to understand your stupid budgeting system.

I’m really sorry to hear this! Please let us know which specifics you are having trouble with. This post definitely covers a fairly advanced setup.

There appears to be something incorrect with this tutorial, or at least very confusing. You have both CATEGORIES and ACCOUNTS named exactly the same “My 401k” and “Savings”. Makes sense I do the same to track the category in the budget but have an actual account where the money exists. On the first screen shot you split the paycheck between CATEGORIES. Then in the budget the categories appear with a negative balance until cash is moved into the “envelope”. Still tracking at this point.

The next part is where my experience with your software differs. In the fourth screen shot you do a transfer from the Savings ACCOUNT to your checking account. To be clear this is recorded as an account to account transfer. Categories are not tracked. When returning to the budget the $50 in your example will not be tracked in the envelope because the transfer was not not tagged to a CATEGORY. In the budget the savings “envelope” will be unchanged. But under budgeted income there is a “Savings” entry with the $50 cash. It can then be moved from the income section to whatever envelope you desire since it is a new source of cash (income).

The “Savings” envelope in the budget created by the CATEGORY “Savings” will not be effected by the transfer unless you fund the envelope from the new $50 income.

I have avoided envelopes precisely because of this issue. I have always been afraid that the software would track this transfer as “new” income and thus skew my yearly earning report.

If I am missing something please advise. I have spent countless hours in your budgeting software and have never been able to create a scenario that you detailed in your article. I love Banktivity and use the budget every month… I just have to keep the envelopes turned off.

I feel the same as Jonathan. There should be a better way to envelope budget savings. It can’t be income as I already have it, but it isn’t really an expense as I still have the money which is available to pre bought back, so it is income again. I too love Banktivity and I am sure you can find an easier way to track this. Just like Jonathan I am confused about the categories and accounts you show. That is why I asked my question above

For the example in this article I do NOT have a category named Savings. I only have the account named that. When you tell the budget to exclude a specific account, the system essentially treats it much like a category. So when I move money from Savings to Checking, the system sees that as money available to disperse from the Savings account. Seems like it would help to have the accounts distinguished in the budget as what they technically are: accounts, not categories.

Anyway, I don’t believe the article has an error (but please correct me if I’m wrong!)

I should have been more clear. In my example, I have accounts named Savings and My 401k. They are NOT categories. I’ll update the screenshot to make that more clear.

It seems redundant to have to manually split the transaction and then also manually recreate that split by moving money from one envelope to another.

I have just done the above and the split put the money into my savings account automatically. I assume this is because in my salary it had a dot in the category and that is the account. I then had a schedule transaction to put the money in the account, but that led to two payments. In my budget it was shown as an expense when it should have been income into my savings account.

https://www.dropbox.com/s/xyokg05emgea474/Screenshot%202018-11-02%2017.29.52.png?dl=0

The above looks so close to what I want, but isn’t quite there yet.

Great article! But there’s a typo to fix in paragraph 1: “If you are knew to envelope budgeting…” 8^)

Doh! Fixed.

I have just tried this and it doesn’t work for me. When I do the split for paycheck and indicate the amount I want to transfer into my Savings account as savings, Banktivity lists the amount as being transferred FROM my Savings account, as opposed to going into the Savings account.

You may think this petty, but it’s not for a lot of people like me who don’t swear. I was so surprised to find any swearing in a financial software training post, of all things. I expect to find it in social posts, etc. But here, it’s totally unnecessary and off-putting. Please, You could have said, “Stuff happens,” like most people do when wanting to respect those who refrain from swearing. Please consider a change for the sake of youth who might want to use your software.

my mortgage Payment changed because of a change in escrows. How do I change it?

Select the mortgage account in the sidebar and go to Account > Edit Loan Information…

For my mortgage, the “Edit Loan Information” is not highlighted and therefore does not allow me to edit it. Am I missing something?

My guess is that the account type is wrong. In Banktivity 7 you can double click the account to change the account type.

I think expenses would be much easier to track in Banktivity if transfers to non-budget accounts could be categorized.

For example, I have a Home & Utilities category, which includes strata fees. I want to include my mortgage in this category, so that I can track all related expenses in one place. However, my mortgage has to be separate from this in my budget, as it is a transfer to my mortgage account. Likewise interest on my line of credit: I want to put it into a Bank Fees category, but it is a transfer to my LOC and is (apparently) “ineligible” for categorization.

I think any expense that is “external” to spending accounts should be categorizable. I want to be able to assign a category to transactions that go out to non-budget accounts like my mortgage or line of credit, while currently Banktivity lists non-budget accounts as their own “categories” in the budget.

I have set everything up as above. It took me hours, and countless do-overs, but I got it to work. The paycheck and mortgage workarounds are clunky, so you have to pay attention to the details. I made sure to check the scheduled transactions in the budget, on the Calendar and in the scheduled transactions list to make sure that everything’s right and there are no double entries.

I hate that there are now a slew of background items clogging up my budget. For example, I track ALL the deductions from my paycheck, so now I have nearly a dozen of extra line items for different types of insurance and taxes that are deducted, in addition to contributions to my 401(k) and my HSA. So, now, to keep the envelopes current, I will have to transfer money from the “Salary” envelope into each of the insurance, tax and contribution envelopes…every two weeks. I can see this becoming very tedious.