Exactly what is inflation?

It’s a word we hear often and usually in a negative economical context. Simply put, inflation is an increase in the cost of goods and services. While no one likes to pay more for something, a low inflation rate (about 2%) is generally a sign of a healthy economy. While it’s true that our dollar’s buying power is weaker, over time wages should adjust. However there are times when inflation is out of sync with wages and things just seem darn expensive. So let’s discuss inflation in more detail and importantly, how you can keep it from busting your budget!

Inflation for the last many years has been very low, but many people are starting to feel it’s rise, and more is likely to come. Finance analysts from the Federal Reserve to Forbes are predicting more inflation in some consumer sectors, jumping at least a full point from April’s 2.1 inflation index. So is there more inflation ahead? If so, how should we prepare for it?

In our research, we’ve seen projections as low as 2.1% and as high as 3.5%. The truth is though, it’s a lot like trying to predict the weather due to the wild variables pushing the economy. Uncertainty remains regarding the impacts of the China Trade agreements and the possibility of new tariffs which could drive up prices for common goods. Equally, sanctions threatened against Iran and Venezuelan petrol have already started price hikes at the pumps. Lastly unemployment is the lowest it’s been in years and likely to stay that way. Some analysts say in the short term this will stimulate more price hikes.

No matter how you slice it, it looks like your dollar (and mine) may not stretch as far as it has been these last few years. This may sound drab, but keep in mind it’s not a recession but just the ebb and flow of the economy. We’re going to discuss exactly what you can do right now and in the coming months to not only get through this but even come out ahead (Yes that’s right, ahead!).

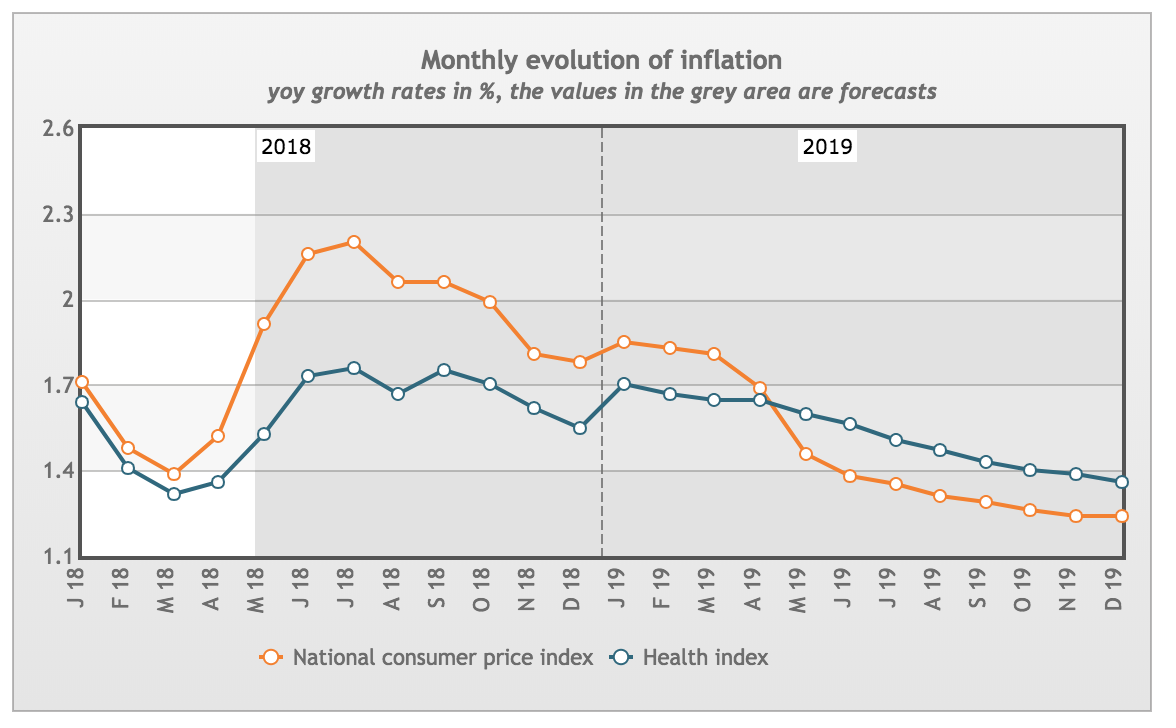

Remember, these are GROWTH RATES of inflation, not an actual measure of inflation. So while longer forecasts suggest the growth rate may slow, it still means inflation may continue to rise.

Four key areas to watch:

Prices at the Pump: Already on the rise, oil and gas prices have reached their highest since 2014 Crude oil’s price per barrel has risen 45% percent in the last 12 months. With the summer demands and uncertainty in world markets, the consensus is prices will continue to climb for some time. We’re already seeing gasoline prices over three dollars per gallon here in New England.

Medical Care Costs: These are expected to rise 2.7%, and of course we can expect that to be passed on in our premiums and co-pays. While the extended average for health care cost inflation is well over 5% don’t be fooled by the apparent inflation drop off in 2018 , medical costs are still one of the largest financial burdens in the USA, and will remain so.

Housing costs: Housing costs are expected to increase 3.5% due to a massive national housing shortage caused by the 08 recession. This means higher rents and mortgages, and unlike other industries, a huge boom in new construction will be required to lower demands and improve available inventories and curb prices downward.

Credit Cards: You’ve probably seen on your credit card applications, the APR you pay is dependent upon the Prime Rate, which has already increased .25 this year to 4.75%. The Federal Reserve will raise interest rates in June, and the Federal Open Market Committee (FOMC)[2] is expected to set the US Prime Rate to 5%. This means you’ll be paying a little bit more interest on your cards than before.

Overall, the averaged prediction for 2018 is a 3% increase in the cost of goods and services, however some categories we’ll be worse or better off than others. The important thing to remember is nobody can say for certain how much inflation we’ll see (if any) or how quickly we’ll see it, but the best approach is to be ready now.

Budgeting proactively by factoring for inflation:

Here is a simple and effective way you can plan ahead, and remember what I said, even come out ahead! If you like keeping things simple, factor three percent increase for all of your budget categories. For example, if you’re budgeting gasoline for your driving needs now at say $400 monthly, bumping that up three percent would be twelve bucks, or $412.

If you prefer to spend a little more time on this and take a more granular approach, look at your categories by industry, and apply what extra you think will cover the impact. Take your credit card payments for example, you may decide a one percent increase makes more sense than three percent. Some categories may not need any adjustment at all.

I like to play on the conservative side and work with the worst case scenario. With my envelope budget, I can always redistribute anything extra from any envelopes with a surplus. Better to have extra cash on hand to move around, than to be underfunded, which is exactly how you can come out ahead, even if there is inflation in the forecast.

[1] https://www.kiplinger.com/article/business/T019-C000-S010-energy-price-forecast.html

[2] http://primerate.fedprimerate.com/search/label/prime_rate_forecast

Good information; however, you forgot about retired folk with NO increase in income like a person who is still employed/working.

I think providing some strategies for retirees on fixed income would be thoughtful.

I agree Jack! If I can’t factor in something for retirement income how can I increase my budget by 3% to cover inflation? I am also waiting to see how the new tax law affects my retirement. Lot to consider these days.

Wrong usage of it’s in paragraph 2. Really?

Thanks Wendy 🙂

I’ve found that not even weather forecasts are worse than economists’.