There are two types of people in this world, those that track their finances and those that should track their finances. I know, some people out there hate numbers. They don’t want to look at their finances. They might not even know where to look if they wanted to. If you don’t track your finances, then suddenly decide to look at them, it’s kind of like taking the Rorschach test – you might interpret them in very, uh, unusual ways. So without further ado, let’s discuss why you need to track your finances and the five most important steps to getting your finances in order.

The truth is, starting to track your finances, looking at them and beginning to understand them, is a lot like taking on a new hobby. At first it might feel foreign and awkward. But as you do it more and more the discomfort will start to fade away. You learn along the way. Some of the initial numbers or graphs you once thought were scary or hard to understand aren’t so much anymore.

Tracking your finances is probably the single most important activity in achieving your financial goals. The funny thing is, once you see it working, you’ll wonder how you ever got by without tracking!

My Story on How I Started Tracking My Finances

When I was in college I was camping in the eastern Sierra Nevada mountains in California. I was sitting around the campfire with my aunt. I don’t remember how it came up, but at some point we started talking about tracking finances. Okay, if I had to really guess how it came up, I was probably politely complaining about being a broke student. Anyway, my aunt said something that would change my life forever.

She said, “I use software to track every one of my purchases so I always know what my account balances are.”

I was floored! “What? Every purchase? What do you do, keep your receipts or something?” I quipped back. (Keep in mind this was before it was easy to use financial software that automatically downloads transactions.)

“Yeah,” she said. “I keep every receipt and once a week or so I enter them into an app.” (And I’m sure she didn’t really say “app” as that term hadn’t been popularized yet, but you get the idea.)

I was shocked. I was amazed. Who in their right mind would do this? Well I guess I wasn’t in my right mind, because I knew that as soon as the camping trip was over, I would try it for my purchases!

So began my long journey with personal finances. As some folks know, I eventually ended up developing Banktivity, and now I run IGG Software. And occasionally I even write articles about personal finances.

Start With Tracking

Tracking your finances is at the root of getting a healthy and realistic view of your money. If you don’t know where you stand, if you don’t know where all of your money is going, it is really hard to make sound financial decisions. So step one, if you aren’t yet tracking your finances, that is the place to start.

I know many of you are already using an app like Banktivity to track your finances. So what advice do I have for you? Well, here are what I believe to be the five most important steps for a sound financial picture.

Live Below Your Means (Know Your Savings Rate)

There’s a reason this one is first. If you aren’t living below your means, you are either burning through savings or going into debt. Put simply, living below your means is spending less than you take in. However, the devil can be in the details. For example, someone might bring in $3,000 a month in income. If they consistently spend less than that each month, then they are living below their means. But notice that I said, “consistently.” If you spend less than you make most months, but then have a few high spending months where you bust your budget, then you aren’t really living within your means.

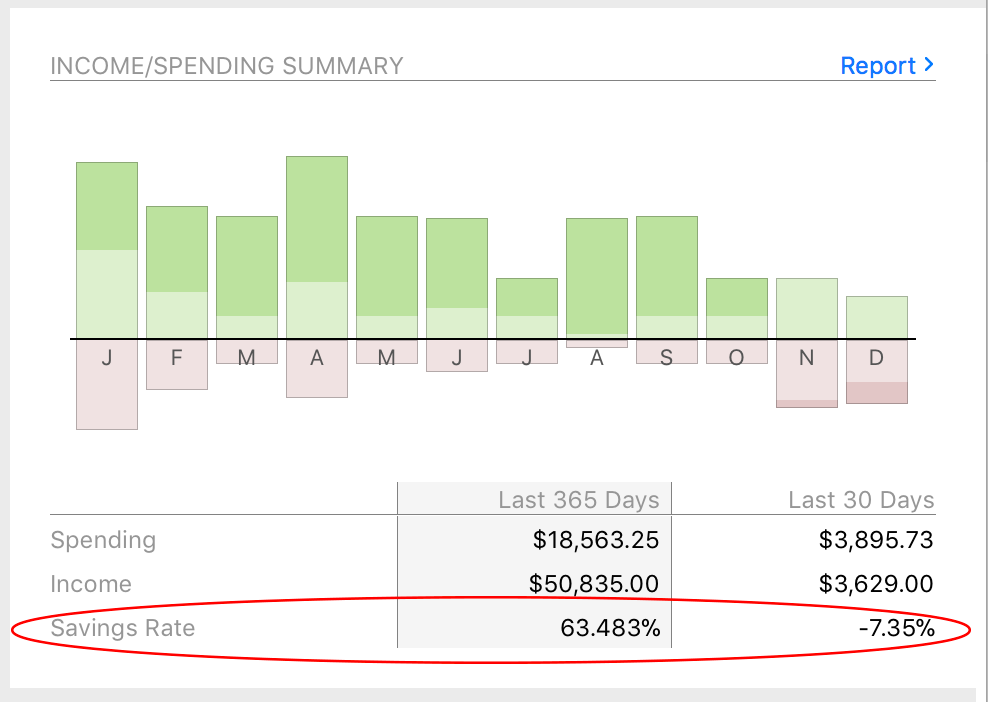

Your savings rate is the metric that indicates if you are living below your means or not. A positive savings rate means you are, a negative savings rate means you are not. The trick is making sure you have a positive savings rate over the long haul. In Banktivity we automatically calculate this for the last year and past 30 days in the summary panel, so you’ll always know where you’re at.

This person was doing great up until the last couple of months.

Develop an Emergency Fund

If you don’t ever have a cash cushion, unexpected expenses can push you to use your credits cards when you shouldn’t be. Let’s say you are more or less living paycheck to paycheck. You know you have some bills coming up, but that’s okay because you get paid soon and you can use that money to cover them. Then, while driving home one evening, your car engine makes a loud pop sound and starts spewing out steam (or is that smoke?) from under the hood. Needless to say, the car isn’t going anywhere that evening, except to the mechanics via tow truck. After they assess the issue, they determine it will be about $800 to fix. Ouch! You don’t have that kind of cash lying around, but you need your car to get to work. So out comes the credit card and you tell yourself you’ll pay it off within three months. But in those three months, that means you are paying a high interest rate on the repair and you aren’t getting ahead at all. You are effectively reset to ground zero or even a little below ground! This is why an emergency fund is so important. Even a fund of just $1,000 would have prevented you from taking on that high interest credit card debt. If you don’t have an emergency fund, it should be your number one priority to build one up. Most experts recommend building up $1,000 first and then eventually trying to build up 3-6 months worth of living expenses. The idea behind the large fund is you’ll be able to weather the loss of a job without taking on any unwanted debt.

If you aren’t sure how you might prioritize building up even a small emergency fund while also paying bills, please checkout our envelope budgeting article. If the idea of a budget sends a chill down your spine, remember, a budget isn’t about spending less, it is about spending right.

Find Free Money

Before you start wandering around outside looking for $20 bills blowing down the street, let me explain what I mean by this one. By finding free money, I mean, see if your employer has any dollar matching as part of their 401k or other retirement plan. Many employers will match dollar for dollar up until a certain percentage. You won’t find a better deal anywhere. This is literally free money and you should not pass it up! There are all sorts of investment brokers and money managers that will show you how well their investments perform, but not a single one of them can guarantee the return you’ll get from just letting your employer match your retirement contribution.

Pay Off Bad Debt

Not all debt is created equal. There are all sorts of loans you can get: student loans, mortgage, car loans, credit card debt, home equity line of credit and so on. But some of these types of debt are worse than others. Credit cards are notorious for having excessively high interest rates (think in terms of 15% or 20% – ouch!) Student loans have better rates, but the amounts can be so large they can take decades to payoff. A mortgage is generally considered okay debt to have, especially if you have no other significant loans. So take a survey of your finances. What sort of debt do you have? Car loans, student loans, credit card debt? Once you know where you stand, come up with a plan to start tackling these debts. You pay a lot of money in interest for having those debts. It’s money that you could be putting towards an emergency fund, vacation or whatever. But when it goes towards interest, it is just another unwanted and seemingly inescapable expense. It’s like having a hole in your pocket and every time you put some money in, a little is lost through the hole.

Develop a Savings/Investment Plan

Once you have your fires put out, i.e. you are living below your means, you have an emergency fund and you’ve paid off your bad debts, it’s time to start thinking longer term. You need to start thinking about long term savings and investing. A good approach is to commit some percentage of your paycheck toward building up your emergency fund. If your emergency fund is swelling at the seams then consider investing your extra savings. It’s never too late to start building up that nest egg. And if you are one of those that think your company’s retirement plan and social security will take care of you, please reconsider!

Summary

People’s finances vary widely. My five steps aren’t the be all end all. It’s hard to prescribe a single approach that works for everyone. But what I hope to leave you with is the importance of changing your attitude about money. If you are too afraid to really dive into your financial situation, it’s going to be hard to make real change. You have to begin with the tracking. You have to see where each dollar is going. Then and only then will you have the right knowledge to start making the right financial decisions.

I learned these basics about 20 years ago, here’s my story. When I was a young guy I made lots of money however I spent every dime and then some. By the time I was 40 I was well in debt and days away from bankruptcy due to over spending and not saving.

Well I turned it around, I began documenting my all my finances, paying off debt and savings. The first basic of any personal finance is NEVER EVER spend more than you make. It’s that simple! My car is 14+ years old and has been paid off for 12 of those years, now it’s just gas and moderate maintenance.

In the past 20 years I have never made more than $85K year. Now its 20 years later and I own 2 homes, 1 being my residence and the other a rental property. The residence is paid for however the rental has a small mortgage but brings in positive cash flow so I can use that to save even more money. I have savings in the low 5 figures for those “just in case times”, I also have an investment account in the mid to high 6 figures. I also manage to take 2 vacations a year. While I do have some credit card debt, only about $4300 at this writing I make aggressive payments monthly to pay that off. Other than the mortgage and credit card debt I own no one anything!

I use the same credit card to pay for basics like my utilities, cell phone, and other household basics to earn points. I then use those points to buy gift cards for presents or to myself if I want a nice dinner out someplace.

So it can be done, first it takes a decision to make a change and after that is just using a little discipline.

The thing that I like the most about Banktivity is that I can capture at any point in time our actual net worth. My wife and I use our credit cards almost exclusively to collect all of the possible bonus miles and points that we can. We are also able to always pay off our credit card balances on the due dates and have not for years had any interest charges added to our accounts. I enter credit charges on a weekly basis and with Banktivity I can always check our net worth. The really nice think about using this program to keep track of income and expenses is that when we pay off the credit cards at the end of the month our net worth of course does not immediately drop since we are just using an asset to pay off a deficit.

Some of the new features are really appreciated. The only problem with the program is that split transactions are not split properly in reports. It would be nice if only the specific part of a split transaction that applies to a specific report showed up in the report.

Absolutely yet intuitively right! It’s not too hard to follow these 5 steps, and Banktivity makes it more palatable! Its continuing improvement in automatically downloading account transaction details has reduced significantly the time I spend reconciling my accounts (once) each month. Moreover, despite the differences between US and Australian retirement investment funds, it is possible to configure Banktivity to accurately handle my Australian position. Just a bit more effort still required by IGG to get all my account providers to come on board with the download process.

Congratulations on the excellent article.

Over the years I didn’t really track my finances and got into heavy debt, even though I was bringing in a decent income.

I was obviously living outside my means and ignored any letters from any financial company such as Banks and credit card companies.

It wasn’t until I downloaded ibank 4 and progressed to Banktivity 6 that I began to track my finances and took note of every single receipt, cash withdrawal etc that the debt gradually disappeared and now I can save for a rainy day, holidays and easily live within my means.

Tracking your finances is truly the way to go to prevent getting into debt or getting yourself out of debt.

Little savings go a long way if you keep on investing them right. I chose Vanguard and those little savings have grown over a period of 39 years into more than a million. I can sell some when we go on vacation or meet some emergency expenses. Banktivity can do a wonderful job here.

How do you make the reports that appear on this text?

Hi Boris, the report you see there is found in the “Summary” view in Banktivity, it’s generated automatically.

I have an entire year, income and expense, listed. I am really interested in doing one month at a time so I can print it out to use for my tax report.

How does saving enter in to a budget? If I take 300 a month to saving is that a bill?

Hi Walt, there are several approaches you could use. For me personally, I have 2 different “savings” budgeted. One is a modest weekly transfer to my savings account, the other is funding an envelope ear marked “rainy day”. Both of these are for money I’m not planning to spend, but the rainy day fund is there for unexpected expenses.

So to answer your question, I don’t view either as a bill, since it’s technically money not spent. But say I had an unexpected auto repair not budgeted for, and it puts my auto envelope over budget, I move what I need from the rainy day envelope to cover it.

I like the manner in which I can list my expense and income, but I would like to do it in monthly increments, and don’e know how to do that.

I like the manner in which I can list my expense and income, but I would like to do it in monthly increments, and don’e know how to do that.