Grab a nice cup of (iced!) coffee, sit back and let’s discuss the debt snowball method, one of the most effective ways at paying off debt. If you carry a balance on your credit cards from month to month, then the debt snowball method is probably just the right thing to start some serious changes with your finances.

Getting rid of debt using the debt snowball method

The method and strategy for the debt snowball method is very straightforward. It works like this, you pay off your credit card (or other loan) with the lowest balance first. While you are aggressively paying down this card, you pay just the minimum on your other credit cards with balances. After the first credit card is paid off you will have some extra money in your monthly cash flow. As tempting as it might be to use it for day to day expenses, don’t! Use it to start paying down your next smallest credit card debt.

Once the next card is paid off, you’ll have even more money in your monthly cash flow – apply this to the next credit card. See the pattern here? As you aggressively pay off each card, you have a larger amount of cash to start paying down the next card. And once the next is paid off, bam, again more cash to apply to the next one. The cash you have to put toward paying down each successive credit card grows like a snowball and before you know it you’ll be plowing your way to being debt free!

The debt snowball method versus highest interest card first

I know what you might be thinking: shouldn’t we pay down the card with the highest interest rate first? You could do this, it’s a very reasonable approach. In fact, you will end up paying less in total interest if you take this approach. But here’s the problem, paying the highest interest card first can be a serious test of your endurance. So much so, that it is easy to fall off the debt reduction band wagon and not make any real progress, and that is not what this is about. People want debt gone, obliterated, the old-shackles off. And this is why the debt snowball method can be so effective.

Getting your first card paid off is a huge achievement. You’ll feel really good about getting rid of an entire payment. In fact, the thinking goes, you’ll feel so good after paying that first card, you will continue to be motivated to start aggressively paying down the card with the next lowest balance. If everyone based spending decisions on 100% logic and math, well, let’s just say there’s a good chance they wouldn’t be straddled with credit card debt to begin with. So the debt snowball method takes a psychological and rewards approach, and quite frankly, for many people it really works.

Debt Snowball Method Example

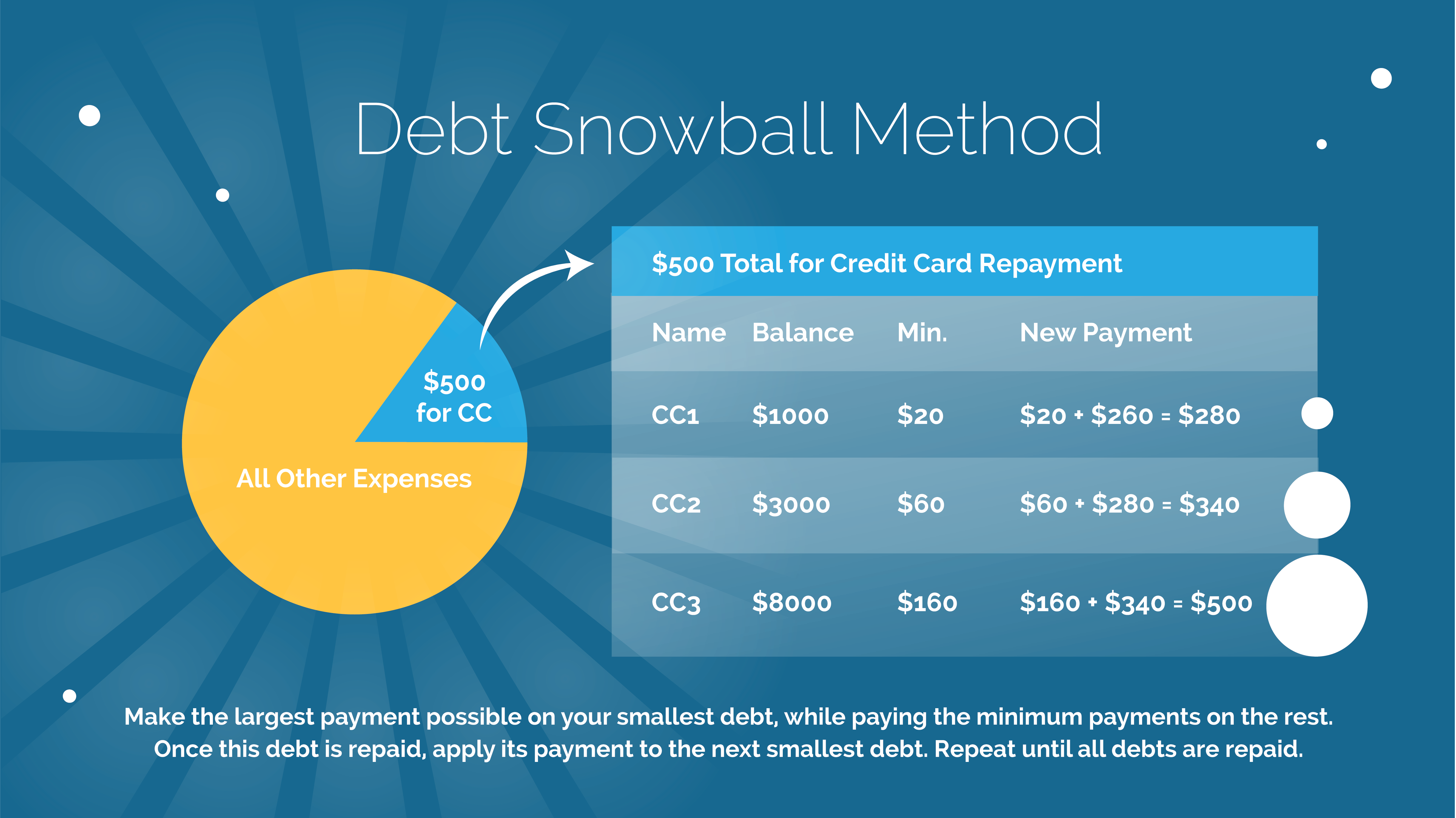

Let’s say you have three credit cards, CC1, CC2 and CC3. Each month you have $500 in your budget to put toward paying down credit card debt. (Of course, because you use Banktivity’s envelope budgeting this is money you’ve ear-marked for debt pay down and you don’t stress about coming up with this $500 each month.) The infographic below shows each card’s balance, its minimum payment and how to split up your payments to take advantage of the debt snowball method.

When paying off the first card, you are making the minimum payment ($20) plus $260. Once CC1 is paid off, you end putting an extra $280 toward CC2 and finally, once that one is paid off, you end up putting an extra $340 toward CC3. You can get those cards obliterated with the snowball in no time!

How to get that snowball rolling

The key to the snowball method lies in the exponential payoff power, but the trick is it requires the momentum of a card or two paid off to really get the snowball effect started. If you’re already stretched tight paycheck to paycheck, it can be challenging to find the extra money to begin.

One option is to make a real, honest effort with a budget that tackles your discretionary spending. A way to hone in on this using Banktivity is with the Monthly Income and Expense Report. A quick glance at the expense categories will show you where you can cut back, and put that money to good use paying off your debt. Another option would be creating secondary income with monthly yard sales, or selling your old unused treasures on eBay. Anything you can do to get that first card or loan paid off will do the trick. Once that first one is done, your snowball is rolling and growing momentum with each card you pay off.

Get out the scissors!

Once some of those ridiculously high interest rate cards are paid down, cut them up. That’s right. Who needs 8 credit cards? Won’t one or two do? Go ahead, cut a few up knowing you won’t ever put a balance on them again. Little credit rating tangent, it’s better if you don’t close your credit card accounts, just use them enough to keep them from going completely dormant. Keeping accounts open for a long time and having a high available credit to debt ratio are both important factors in your credit score.

Using the debt snowball method in Banktivity

In Banktivity, the first thing you want to do is add all of your credit card and loan accounts. Then group these accounts into a folder called “Credit Cards.” Of course, you could get more creative and name the group something like “Regret Cards” or “Scissor Targets.”

Credit cards ordered in order they will be paid off, and grouped with a meaningful title.

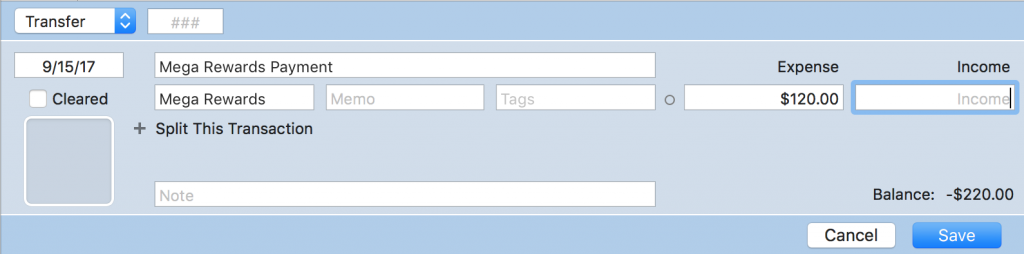

Then when you make a payment on the card, say from your checking account, record this in Banktivity as a transfer from the Checking account to the Credit Card. This will result in your checking account balance going down a bit, and your credit card balance going up the same amount. That’s right, going up. This is because a credit card balance in Banktivity is negative because it represents money you owe. Once you get the credit card balance to zero, it’s paid off.

This is how the transfer transaction looks in the Checking account, notice “Mega Rewards” entry indicating money will be transferred to that credit card account.

If you are trying to juggle multiple credit card balances and or paying down student or car loans, the debt snowball method strategy may be good for you. It’s a great feeling getting that first credit card paid, in fact, the feeling is so good, you’ll want to start on your next credit card right after that.

Well, I enjoyed reading this!

This is an interesting read. Ive been trying to do the highest interest first method but with limited payments available I kept “falling of the wagon” as is suggested.

I’ll make this a 2018 plan and see how it goes.