Investing has never been easier for the general public. With the onset of online trading and various apps, it doesn’t take much to invest a little of your extra cash. But for many, the idea of investing immediately invokes walls of fear and the idea that it is too complex for a lay person. In some ways, now that there are so many options available to the casual investor, it is actually creating a barrier to entry. I mean, where do you start when faced with names of apps like Acorns, Robinhood and Betterment, not to mention the “old” players like Fidelity, Vanguard, TD Ameritrade and Scottrade (to name a few)?

In this article we do a deep-dive into DIY investing. We will cover exactly what we mean by DIY (hint: roboadvisor firms don’t count!), why you should consider DIY investing and even a few different DIY strategies.

Why DIY?

There are a plethora of companies out there that would just love to help you invest your money. Why? Because they make money by managing your money, regardless of whether they do a good job at it. Yep, that’s right. You might give them $1000 to invest and after a year, if it is only worth $900 (10% loss, ouch!), they still get paid. So one of the biggest reasons to do it yourself is to avoid the fees.

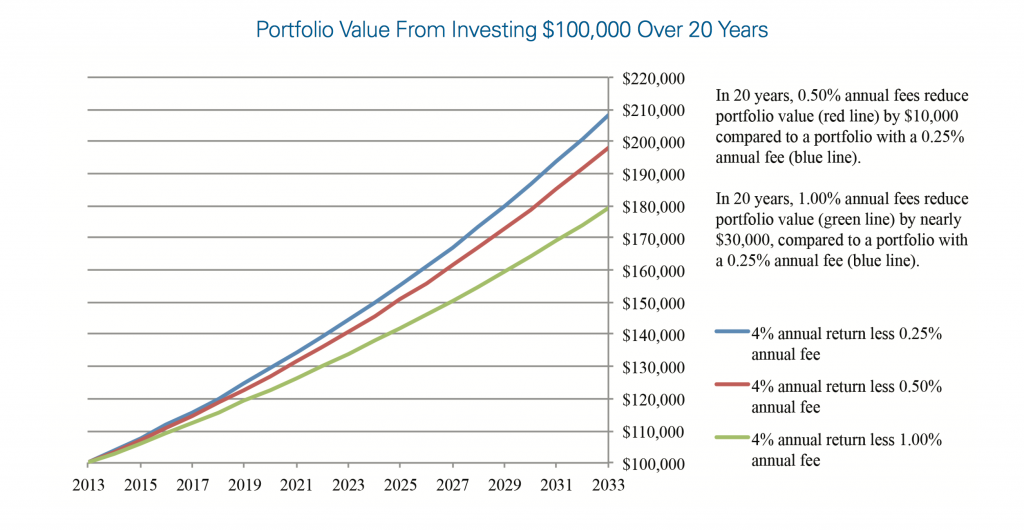

While fees appear small, they can seriously eat into your long term gains. Kind of amazing when a 0.5% or 1% fee doesn’t sound like much. So take a look at this example: if you start by investing $100,000, would you rather have $180,000 in 20 years, or closer to $210,000? Obviously, you’d rather have the larger number, but you won’t get that if you’re getting hit with just a 1% fee. The graph below will help you visualize it:

I don’t know about you, but I want my money on the blue line, or even higher!

How to DIY

So let’s get into the meat of this thing. How do you go about buying and managing your own investments? Before we jump in to what we recommend, please note that we are not investment advisors. You should do your own due diligence. With that said, let’s talk about a few different strategies and, ultimately, we will tell you the one we think makes the most sense for most people.

Option 1, The Stock Purchaser

You could open an account at a brokerage firm like Fidelity, Vanguard, Scottrade, etc. and buy and sell individual stocks. However, we really don’t recommend this approach for most people. To be successful with this approach (and there is no guarantee you will be successful) you need to do a lot of research and be prepared to see a lot of volatility in the value of your portfolio.

Option 2, Managed Mutual Funds

Managed mutual funds have been around for a long time. Here is the idea behind them. A firm hand picks a selection of stocks and packages them up as a fund. For example, someone might put together a fund that is based on the performance of the best energy stocks. They might call this, “Black Cloud Energy Fund.” Investors then hand pick energy-related stocks that they think will do really well. When the stocks in the fund do well, the price of the fund goes up; when the stocks go down, the fund goes down. The problem with a fund like this is that it might come with a 1-2% fee and no guarantee that it will do any better than, say, an energy sector index fund, which would just have all energy stocks in it.

Option 3, The Roboadvisor

Roboadvisors (like Betterment) have been gaining in popularity recently. But let’s be honest, this isn’t a DIY approach. You pay higher fees to have a someone (or a computer in this case) manage what you are invested in at any one moment. So, let’s not go any further down this road. While this approach is still probably cheaper than hiring a financial and investment advisor, we still don’t consider it DIY. We won’t fault you for going this route, but we think there are better options. And besides, with the other options you’ll learn more too!

Robo-advisors are neat, but true DIY’ers learn to well, DIY

Option 4, Index Funds

Ding, ding, ding! This is our favorite approach. Index funds are just collections of stocks based on many different indexes that exist today. For example, you could have an index fund that represents the Dow Jones Industrial Average (DJI) or the S&P 500. If you own shares in one of these indices, then when they go up, you make money, and when they go down, you lose money. This is pretty straight forward. But you might be wondering, “OK, but aren’t there some investors that can pick stocks for me that will do better than the S&P 500 or DJI and, even with their fees, I’ll be better off?” Yes, I’m sure some of these people exist, like Warren Buffet, but if you look at the majority of investors or managed mutual funds and compare their performance to some of the major indices, very few actually beat them.

Buying index funds isn’t free, but the fees are very small because no one needs to be paid to manage them. That is, the fund just needs to represent the stock in an existing index, like the S&P 500 or even the entire US stock market; there isn’t someone researching every company and trying to figure out if they might be a good buy or not.

Even in the world of index funds, there are a ton to choose from, so what is a DIY investor to do? Again, we don’t give financial advice, but a very popular option is to do the Three Fund Portfolio.

Three Fund Portfolio

The three fund portfolio is an investing strategy popularized by Jack Bogle, the founder of Vanguard. In the three fund portfolio, a DIY investor chooses three index funds, one to represent domestic stock (like the US Total Stock Market Index Fund), one to represent bonds like (US Bond Index) and one to represent international markets (like the International Stock Market Index Fund). A DIY investor decides what relative proportions of these three types of funds they want to own, but then that is it.

So if you wanted to adopt the three fund portfolio strategy, there is really one main decision that needs to be made: what relative proportions of these funds are you interested in? In general, the younger you are, the more aggressive you’ll want to be with owning the US Stock Market Index. One rule of thumb people toss around is, “own your age in bonds.” So if you are 30 years old, invest 30% of your money in a bond index, and invest the remaining 70% in a foreign and domestic stock market indices. And how should you split the 70% across domestic and international stocks? Often people go with 10-15% in international stocks.

If you adopt the three fund portfolio, there are a few more things to keep in mind. The bond portion of the portfolio will help keep things stable. Bond yield and prices don’t fluctuate nearly as much as stock prices do. So if you want your money to be very stable, you should overweight the bond portion of the portfolio. If you are very young, say 18, and you aren’t adverse to risk (after all with great risk comes great gains) you can invest heavy in the stocks side and light on the bonds.

The three fund portfolio offers a great long term strategy for the DIY investor. It is simple and easy to understand, and precisely because of these qualities, you are likely to stick with it. If you need to open up an account where you can buy these types of funds, we recommend Vanguard (no affiliation and we get no kick-back for recommending them) because it has some of the lowest fees around. Vanguard can keep its fees low because it “reinvests” any profits by lowering fees for account holders. It is very similar to a credit union, except it is a brokerage, which is a big plus in our book!

Target Dated Funds

If the three fund portfolio still sounds like a little bit much, there is another great alternative that you can truly “set and forget” – the targeted date fund. In targeted date funds, you decide which year you think you’ll retire. So if you are 32 today, and guess that you will retire at age 65, you have 33 years until retirement. That means the year will be 2050 when you retire (wow, that seems like forever away!). When shopping for a targeted date fund, you’ll pick a fund a fund based on 2050. It might be called something like “Target dated fund 2050.” In these types of funds, the ratio of stocks to bonds will decrease as it approaches 2050. This means your invested money will become less and less volatile as you approach retirement.

DIY investing should not feel unapproachable. Yes, there are many choices in today’s world, but don’t get distracted with the noise. A targeted date or three fund index portfolio offers a great way to get in the market without worrying about underperforming it And that is the beauty of it, you can’t underperform the market when you own the market.